KNOWLEDGE BASE Billing Regulations In The UK

The information on this page was current at the time it was published. Regulations, trends, statistics, and other information are constantly changing. While we strive to update our Knowledge Base, we strongly suggest you use these pages as a general guide and be sure to verify any regulations, statistics, guidelines, or other information that are important to your efforts.

Brexit Update:

Since the UK officially left the European Union on January 31, 2020, the relationship between the two has evolved and continues to be shaped by the ongoing implementation of the withdrawal agreement.

Key Dates:

-

January 31, 2020: UK officially left the EU and entered a transition period that ended on December 31, 2020.

-

December 31, 2020: The transition period ended, and the UK fully exited the EU single market and customs union.

-

January 1, 2021: The UK-EU Trade and Cooperation Agreement came into effect, outlining the post-Brexit relationship between the two entities.

-

2023/2024 Current: The UK and EU are still navigating the ongoing implementation and potential revisions of their post-Brexit relationship.

It's crucial for businesses operating in either the UK or the EU to stay informed about the latest developments and adjust their operations accordingly.

Billing Regulations In The UK

Invoicing

When you sell a customer a product or service, you are required to give him an invoice if you are both registered for Value Added Tax (VAT), i.e., a business to business transaction. An invoice is not the same as a receipt. The invoice must clearly display the word “invoice” and include the following:

-

a unique identification number;

-

your company name, address, and contact information;

-

the company name and address of the customer you are invoicing;

-

a clear description of what you are charging for (good or service);

-

the date the goods or service were provided (supply date);

-

the date of the invoice;

-

the date the payment is due;

-

the amount(s) being charged;

-

VAT amount, if applicable; and

-

the total amount owed.

More detailed information about VAT Invoice requirements can be found here.

Returns and Refunds

Under the Consumer Rights Act 2015 and the Consumer Contracts Regulations 2013, consumers may be entitled to a return, replacement, repair, and/or compensation if a good is faulty, not as described, or unfit for its purpose. Consumers are also entitled to a refund and/or compensation if the seller had no legal right to sell the good(s).

![]()

In most other situations, e.g., when a customer buys a jacket in the wrong size, he changes his mind, or an item is an unwanted gift, there is generally no right to return the good(s).

In general, there is no requirement that you have or state (written or otherwise) your return/refund policy. You are allowed to provide more return/refund rights to your customers. If you do offer more rights than legally required (generally only if the good is faulty, not as described, or unfit for its purpose), you can impose conditions, such as:

-

a requirement that the return be accompanied by the original receipt;

-

a requirement that the return be unused and in unopened packaging;

-

a deadline for returns; or

-

an offer to exchange or an offer of a credit note, but not a refund.

You can ask your customer for proof that he bought the item from you. This could be a sales receipt, a bank statement, or the packaging. You only have to accept returns from the person who bought the item from you.

You should ensure that your refund policy does not mislead consumers about their legal rights. It is therefore good practice to state this explicitly, i.e., 'this policy is offered in addition to your legal rights'.

The following would be an acceptable returns policy:

Your legal rights: When you buy goods from a business, you legally have a number of rights as a consumer. These include the right to claim a refund, replacement, repair and/or compensation if the goods are faulty or misdescribed.

Our policy: In addition to your legal rights, we also allow you to return goods if you simply change your mind. Please return the unused goods to us with the original receipt within 14 days and we will offer you an exchange or a credit note.

Under the Consumer Protection from Unfair Trading Regulations 2008, it is a criminal offense to mislead a consumer about her rights. The following are examples of statements that are likely to mislead consumers about their rights:

-

‘No refunds.’

-

‘Good can only be exchanged.’

-

‘Only credit notes will be given for faulty goods.’

-

‘Sold as is.’ or ‘Sold as seen.’

-

‘No refunds except when goods are faulty.” (This statement is illegal because there are a number of situations in which a customer can claim a refund on goods that are not faulty, e.g., goods are not as described).

Goods Bought in a Shop

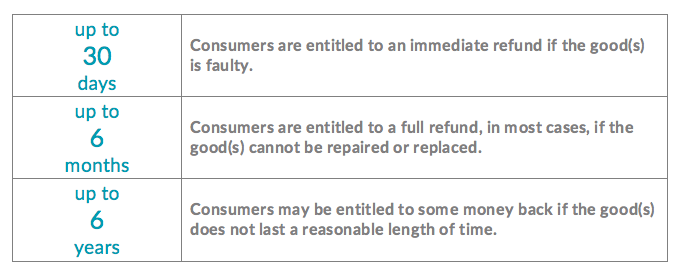

Under the Consumer Rights Act 2015, goods must be as described, fit for the purpose, and of satisfactory quality. During the expected lifespan of the product:

Consumers do not have a legal right to a refund or replacement simply because they change their mind.

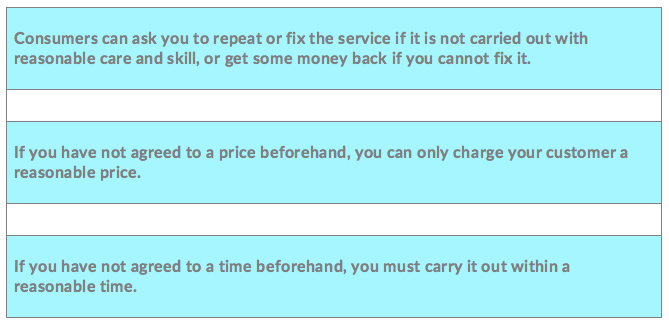

Services Paid for in a Shop

Under the Consumer Rights Act 2015:

-

Consumers can ask you to repeat or fix a service if it is not carried out with reasonable care and skill, or get some money back if you cannot fix it.

-

If you have not agreed to a price beforehand, you can only charge your customer a reasonable price.

-

If you have not agreed to a time beforehand, you must carry it out within a reasonable time.

Goods Ordered at Home (Online, Mail, and Telephone)

Under the Consumer Contracts Regulations 2013:

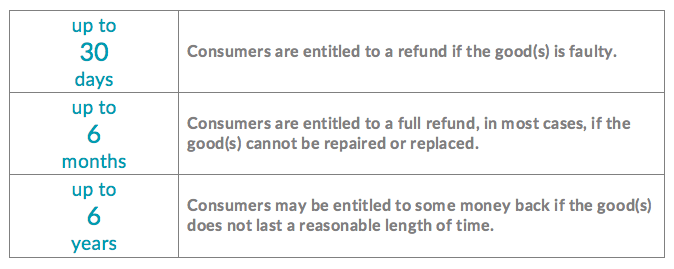

Under the Consumer Rights Act 2015, goods must be as described, fit for the purpose, and of satisfactory quality. During the expected lifespan of the product:

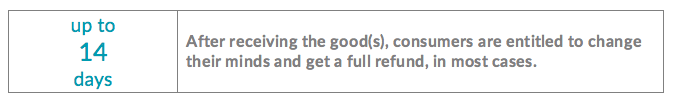

For goods ordered at home, you must offer a refund to your customers if they have told you within 14 days of receiving their good(s) that they want to cancel the order. The consumer then has 14 days to return the good(s) to you. You must provide the refund within 14 days of receiving the good(s) back. The consumer does not have to provide a reason for the return.

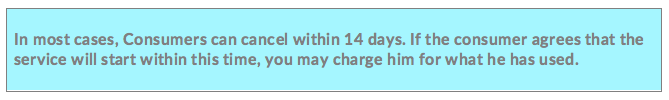

Services Ordered at Home

Under the Consumer Contracts Regulations 2013:

Under the Consumer Rights Act 2015:

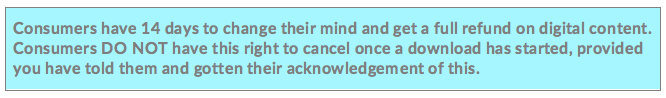

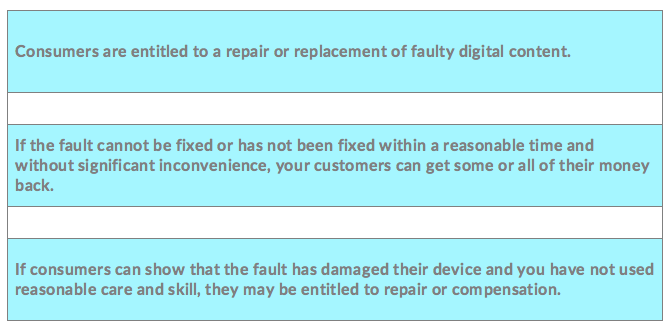

Digital Content

Under the Consumer Contracts Regulations 2013:

Under the Consumer Rights Act 2015, digital content must be as described, fit for the purpose, and of satisfactory quality and:

Consumer Contracts Regulations 2013

KNOWLEDGE BASE Billing Regulations In The UK