KNOWLEDGE BASE Employment Law In Singapore

The information on this page was current at the time it was published. Regulations, trends, statistics, and other information are constantly changing. While we strive to update our Knowledge Base, we strongly suggest you use these pages as a general guide and be sure to verify any regulations, statistics, guidelines, or other information that are important to your efforts.

Employment Law In Singapore

The Employment Act

Under Singapore law, the relationship between an employer and an employee is governed almost exclusively by contract. In general, parties are free to contract as they choose, with few statutory requirements and limits provided through legislation and public policy. The Employment Act is Singapore’s main labour law. The Act applies to all employees under a contract of service (employment contract) with an employer, with few exceptions. It covers the basic terms and conditions in the workplace.

To whom and what does the Employment Act apply?

The Employment Act applies to all of your employees, local and foreign, with whom you have an employment contract. The Act applies to employees who are:

-

full-time

-

part-time (employees hired to work less than 35 hours per week)

-

temporary

-

contract

-

hourly

-

daily

-

monthly

The Act does not apply to: managers and executives who are paid more than a base monthly salary of $5,000, seafarers, domestic workers, and statutory board employees or civil servants.

Part VI of the Employment Act, which provides for rest days, hours of work, annual leave, and other conditions of service, only applies to:

- a workman (manual labor) earning a basic salary of less than $4,500 and

- employees who are not considered workman, but who are covered by the Employment Act and earn a base monthly salary of no more than $2,500.

Important Terms

Base Salary - Base salary does not include payment for overtime, bonuses, annual wage supplements, productivity incentive payments, reimbursement for special expenses and all allowances.

Manager or Executive - A manager or executive is anyone who has executive or supervisory functions. These functions include: influencing or making decisions on issues such as hiring, discipline, firing, performance assessment and reward; formulating strategies and policies of the business; and managing or running the business. This also includes professionals with higher education and specialized knowledge or skills whose employment terms are like those of managers and executives. Examples include: lawyers, accountants, doctors, and dentists.

How do I comply with the Employment Act?

The Employment Act spells out the responsibilities of employers and right of employees under an employment contract in Singapore. If your employees are covered by the Employment Act, your contract must not include terms that are less favorable to your employees than the Employment Act minimum requirements.

Hiring

Your employment contract is the most important document because it outlines the terms and conditions of employment between you and your employee. Although you can certainly draft your own employment contract, it is advisable that you seek guidance from an attorney or an HR consultant. Below is a nonexhaustive list of terms and conditions you should include in your employment contract:

-

employment position

-

duration of contract, if applicable

-

commencement date of employment

-

remuneration package details

-

salary details

-

hours of work

-

employee benefits

-

holidays

-

leave

-

probation period clause, if applicable

-

employee code of conduct

-

termination details

Singapore also provides contract guidelines on its Ministry of Manpower site.

Firing

If a contract of service includes a termination date, such as the completion of a specific project or the end of an agreed to length of time, employment will terminate on that date. If there is no termination date specified in the contract of service, the employment will continue until terminated by either party. Either party can give notice to terminate the contract as provided for in the contract, in the absence of notice terms in the contract, Part II of the Employment Act provides specific timeframes based on the length of employment.

Salary and overtime payment

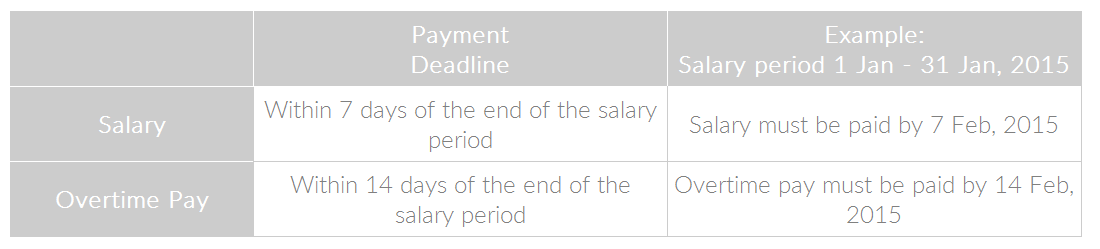

There is no minimum wage or salary in Singapore, therefore, it is subject to negotiation between you and your employees. Wage or salary details, including annual bonus details, should be clearly laid out in the employment contract. Salary and overtime payment must be paid to your employees at least once a month, according to this schedule.

An annual bonus equivalent to at least one month’s salary, commonly known as the 13th month payment, has become common practice in Singapore. The exact amount of a bonus will obviously vary among companies and will often depend on employee and company performance, but in good economic times, it is not uncommon for employees to receive 2-3 times their monthly salary as a bonus.

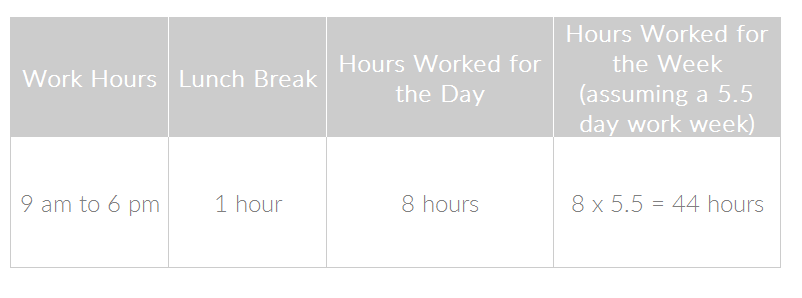

Working hours

Contractual hours (excluding break time and overtime) must not be more than 8 hours per day or 44 hours per week.

All hours worked in excess of the contractual hours (44 hour maximum) are considered overtime. If you require your employees to work overtime, the pay is 1.5 times the basic hourly rate. In general, including overtime, employees should not work more than 12 hours per day.

In general, office employees in Singapore work Monday through Friday from 9:00 am - 6:00 or 7:00 pm. It is not uncommon for them to work 9-10 hour days during the week and work half a day on Saturday.

There are many types of compensation provided to employees in addition to their normal wages or salary. Many benefits are required by the Employment Act, but you should also know and consider common practice in Singapore when negotiating your employment contracts. Below is a brief explanation of the benefits you should include or consider including in your employment contracts.

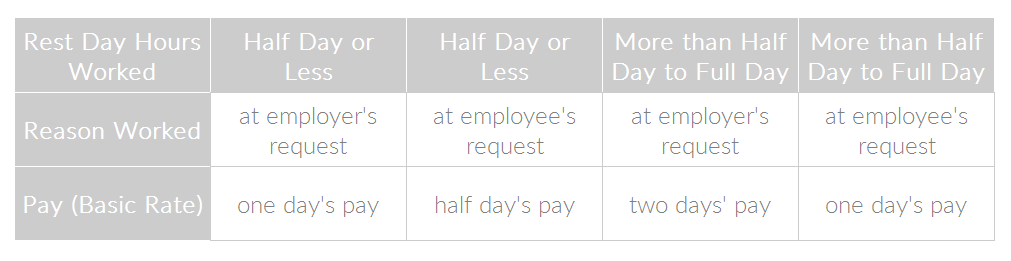

Rest days

You must provide your employees with at least one unpaid rest day per week. If an employee works on his rest day, you should pay him as follows:

Public holidays

All employees are entitled to 11 paid public holidays per year or payment-in-lieu or a replacement day-off. If your employees work on a public holiday, you must pay them an extra day’s salary on top of that day’s salary. Public Holidays in Singapore are as follows:

-

New Year’s Day

-

Chinese New Year (two days)

-

Chinese New Year (two days)

-

Good Friday

-

Labour Day

-

Vesak Day

-

National Day

-

Hari Raya Puasa

-

Hari Raya Haji

-

De epavali

-

Christmas Day

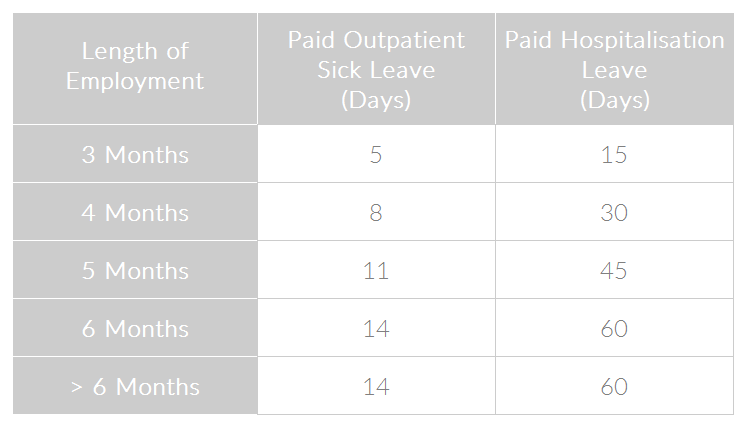

Sick leave

Employees are entitled to paid outpatient sick leave and hospitalisation leave per year if they have:

-

worked for you for at least three months,

-

obtained a medical certificate (doctor’s note) from a company or government doctor, and

-

informed you of the sick leave within 48 hours.

The number of days of paid sick leave an employee is entitled to depends on the length of his employment. The table below lists the sick leave available to employees by length of employment.

Annual leave (Vacation)

The amount of annual leave you give your employee can be negotiated and should be written into the contract of service you enter into with your employees, with the minimum legal requirement based on the employment length, as shown in the table below.

In Singapore, it is common practice to give all employees 14 days of annual leave.

![]() You will be required to maintain detailed employment records of your employees and provide all employees with an itemized payslip and key employment terms. There is also a new framework for handling less serious breaches of the Employment Act. These amendments apply to all employees covered by the Employment Act.

You will be required to maintain detailed employment records of your employees and provide all employees with an itemized payslip and key employment terms. There is also a new framework for handling less serious breaches of the Employment Act. These amendments apply to all employees covered by the Employment Act.

Part-time and fixed-term or project-term employees

In Singapore part-time and fixed-term or project-term employees enjoy most of the same benefits full-time employees have. A part-time employee is an employee who works less than 35 hours per week under a contract of service. All benefits should be pro-rated based on the number of hours the employee works, this includes paid public holidays, sick leave, annual leave, and childcare leave.

In Singapore it is common practice that these types of employees are not entitled to certain privileges full-time employees normally enjoy, including: bonuses and medical insurance.

Hiring students

You can hire students who are Singapore Citizens or Singapore Permanent Residents full-time or part-time without restriction. Students are entitled to Central Provident Fund contributions, unless specifically exempted. If you hire a student as an intern, you are not required to make Central Provident Fund contributions because he or she is undergoing training in your organisation as part of his or her curriculum.

It is common practice to pay interns a monthly allowance.

Foreign students are not allowed to work in Singapore unless they have been granted a Work Pass exemption under the Employment of Foreign Manpower Notification. If you want to take a foreign student on as an intern, you must apply for a Training Employment Pass or Training Work Permit on his or her behalf.

Central Provident Fund

If your employees are Singapore Citizens or Singapore Permanent Residents, under the Central Provident Fund Act, you are required to pay Central Provident Fund (CPF) contributions for them. This applies to all employees making over $50 per week, including part-time, ad hoc, contract based employees, and during an employee's’ probation period. CPF contribution rates are determined by considering:

-

employee’s age group,

-

employee’s wage band, and

-

employee’s citizenship (i.e., Singapore Citizen or Singapore Permanent Resident

Contribution rates for Singapore Permanent Residents during their 1st and 2nd year of work are calculated using graduated rates. CPF contributions are calculated based on your employee's’ total monthly wages. The Central Provident Fund Board developed a free web-based application that automatically computes CFR contributions, provides a breakdown and provides an up-to-date explanation of contribution rates and a calculator (for employees) to help you determine your contribution rate for your employees.

![]()

Central Provident Fund contributions do not apply to foreign employees.

Ministry of Manpower: Guide on employment laws for employers

Employment of Part-Time Employees Regulations

Ministry of Manpower: Employment of Foreign Manpower Act Guide

Ministry of Manpower: Guide to written key employment terms (KETs) and itemized payslips

Central Provident Fund Board: Contribution Calculator

KNOWLEDGE BASE Employment Law In Singapore